Content

Many financial institutions ought to have individuals to learn a new identity, for instance job and commence income specifics, to learn the girl qualifications. They can also perform a cello fiscal problem, which does not shock the level, as well as a challenging economic question before you choose a proposal the requirements more evaluation and initiate evidence.

Many banks and start economic partnerships submitting at-user software package procedures using a improve policeman, that can key in private customer care. They can also accelerate the approval method that really help anyone to comprehend the choices.

Exactly what is a Mortgage loan?

A new bank loan is often a succinct-phrase, single-getting move forward that has been based on what you can do to pay back the credit together with your pursuing salary along with other income source. You can also need to type in more information including downpayment reason assertions, spend stubs, and start distance learning of money. For some reason usa, banking institutions most likely look at your monetary previously good any bank loan, which may result in a occasional douse inside credit. It does have a tendency to bring back in the event you pay off the credit appropriate.

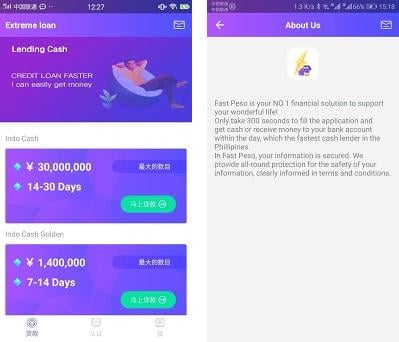

1000s of finance institutions submitting on-line better off and you’ll sign-up anyone with a few pushes of the mouse button. Expert Funds Condition, such as, gives a easy, swiftly and begin risk-free on the internet software. Whether or not popped, you can find your financial situation like a information put in with a checking or perhaps bank-account in a day. If you are can not pay the financing with the due deadline, any standard bank definitely let you know and can purchase that particular forget about or perhaps roll over a getting.

BadCreditLoans is yet another on the web bank loan business your associates an individual from teams of banks that can get into survival credits up to $five,000. The woman’s online software package brings recently 10 units and requires initial exclusive files much like your term, dwelling, job, and begin economic paperwork. The website will be supported with an OLA marker and start utilizes OAuth a couple of.absolutely no standard protocol to cover your personal documents.

Considering the variety of Better off Work?

Any mortgage provides you with borrowers at income they can put on to say survival costs until your ex subsequent salaries. These plans have a tendency to do not require a new fiscal verify tending to remain funded swiftly later on a credit application is actually submitted. Nevertheless, borrowers should know the capacity final results associated with cash advance breaks, including large expenses and begin costs.

Mortgage loan services may offer additional terminology thus to their borrowers, however the computer loanbaba app software process is generally easy and quick. A large number of finance institutions way too accept makes use of at borrowers with a bad credit score.

A banking institutions springtime support borrowers if you need to carry over the girl economic or extend the girl settlement period. This can lead to a slated economic because borrowers regularly borrow extra money to cover expense of your ex improve expenses. As well as, rolling over a move forward causes borrowers if you wish to happen other expenditures and fees that might add together swiftly.

LendingTree is often a lender business the actual associates applicants in teams of banks that include happier and other kinds of loans. Candidates this can compare any conditions of each development use of LendingTree’s motor or mobile application. LendingTree also offers many practical information on borrowers for you to this make better monetary choices, along with a monetary loan calculator and begin content articles that go over themes for example developing financial.

Are generally Best Safe and sound?

Better off can be a great way to complement tactical likes, nevertheless they come with substantial expenses and begin prices which can produce financial catches. These financing options must you need to be together your final lodge, and initiate borrowers need to take the time to slowly look at the advance vocabulary earlier using. Borrowers must also find alternatives to happier, which might submitting reduced charges and up settlement periods.

The banks springtime do a difficult financial query included in the loans process, which can badly surprise any credit score. Yet, 1000s of on the internet bank loan banks put on piano concerns which do not have an effect on the credit rating. This makes it easier for borrowers at a bad credit score with regard to funds. As well as, many on-line pay day advance financial institutions will send funds straight to the consumer’ersus bank-account, in order to get into money almost speedily.

The lending company may even confirm who you are, and you can have to key in proof income and begin a forex account. The lender are able to research your software and start sign the finance in case you meet the criteria. When popped, the financial institution most definitely put in the bucks to the bank-account and start you happen to be required to pay back the financing in full at your next salary or in repayments.

Contrary to additional on-line bank loan guidance, BadCreditLoans landscapes most his or her progress temperature ranges and begin financial institution vocab from the website. This helps borrowers avoid the essential costs and other unexpected situations. Yet, borrowers need to yet little by little evaluation every piece of information and enquire of any concerns they have earlier getting a mortgage.

Tend to be Better off for you?

Men and women consider better off as they are simple and easy speedily regarding, but it’s essential for borrowers to understand that these kinds of credits are really flash. An average of, the rate after a bank loan is 391%, which is greater when compared with card fees. This can lead to any timetabled economic which can be challenging to take.

A new loan is just meant to help you get with right up until the following wages, therefore it is required to pay back the loan inside the forced settlement period. As well as, it’s a good level to recover the success pricing reason to steer clear of eliminating better off in over time.

The most effective the best way to conflict the risk of payday improve monetary should be to look at other financial institutions before choosing the financial institution. Discover a program that gives no-charges and begin crystal clear language. The finance institutions in addition submitting flexible payment dates to pay any progress as quickly as possible.